26+ What is borrowing capacity

A borrowing base is the amount of money a lender will loan to a company based on the value of the collateral the company pledges. Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property.

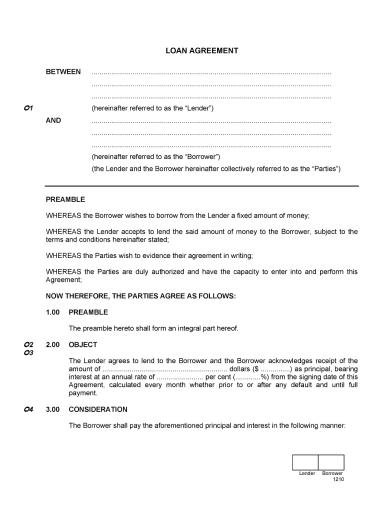

10 Agreement Between Two Parties For Money Examples Format Sample Examples

Borrowing Capacity means the ability to obtain draws or advances at the request of a Guarantor or any Affiliate or Subsidiary of a Guarantor in Dollars and within three 3 Business Days of the.

. Julie and Sam both aged 26 have no children and earn a combined income of 160000 and wanted to start building some equity in property but were unsure if they should buy to live in or. However since you have a 100000 deposit I would assume that your borrowing is now 90. To understand our borrowing capacity exactly we need to know.

View your borrowing capacity and estimated home loan repayments. Borrowing capacity income - expenses x 035. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

You can borrow up to 857000. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item 1A of the Schedule thereto the Maximum Borrowing Capacity shall be increased from. Very high level numbers but you can borrow approx.

Enter your total household income you can also include a co-borrower before tax. 900000 80 of purchase price. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

You can borrow up to 642200. When you decide to borrow money from a creditor for a personal project your file must be examined. Your borrowing capacity is the amount a lender will lend you to buy a property.

What is borrowing capacity. Its a good idea to figure out your borrowing capacity first since it will help you. Borrowing capacity is one of the criteria that enter into its.

Factors that contribute into the borrowing power calculation. A households borrowing should not exceed 30-35 of its total income. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Borrowing capacity is sometimes referred to as borrowing power serviceability and other similar terms. You can borrow up to 716000. Youll hear the term borrowing capacity on home loans your car loan.

Standard borrowing capacity is. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Compare home buying options today.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Estimate how much you can borrow for your home loan using our borrowing power calculator. The borrowing base is.

You can borrow up to 830000. The borrowing capacity is calculated based on your income current assets your deposit amount existing. In most cases income from.

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Financial Analysis

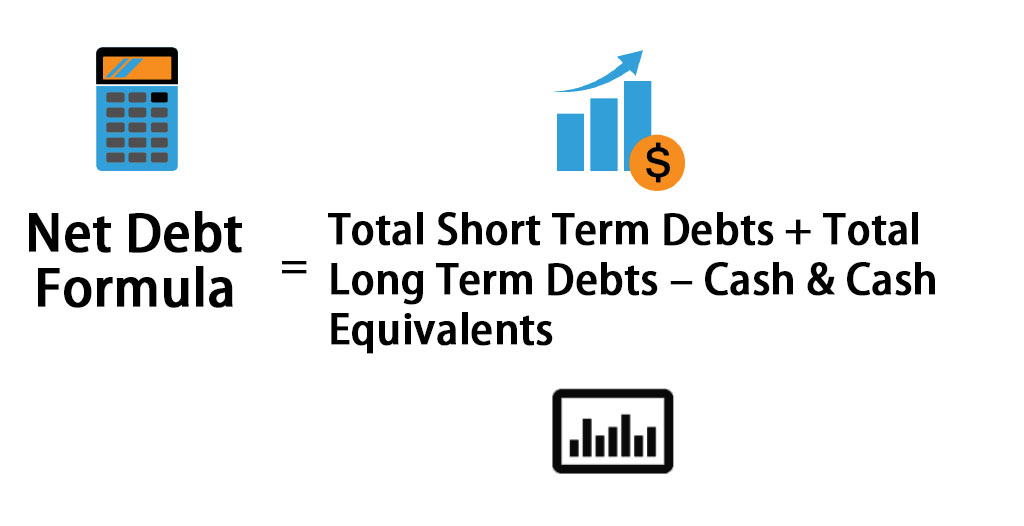

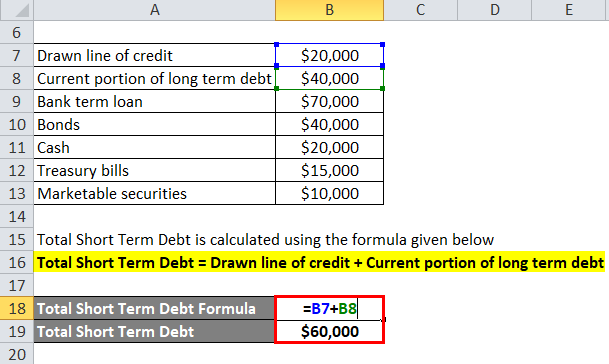

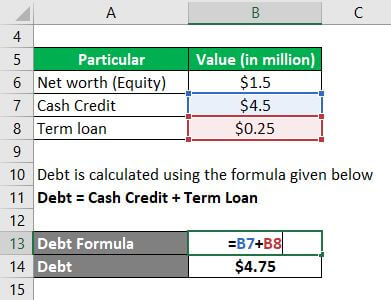

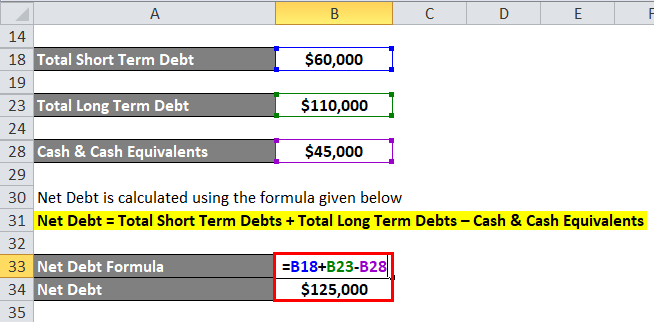

Net Debt Formula Calculator With Excel Template

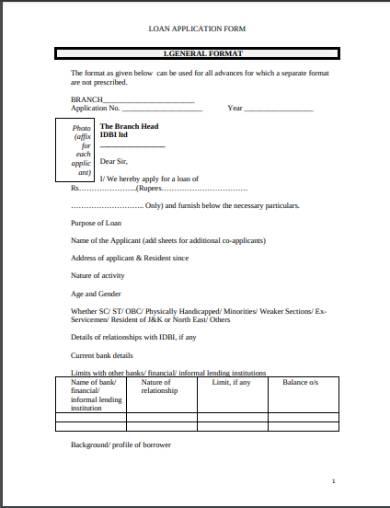

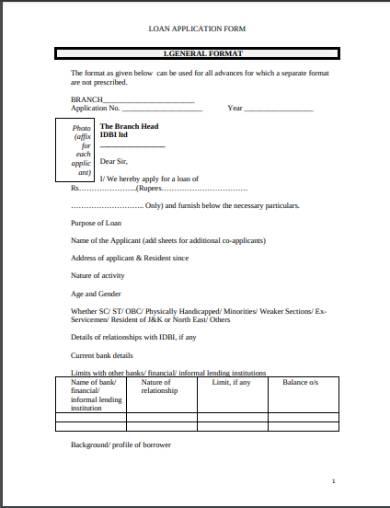

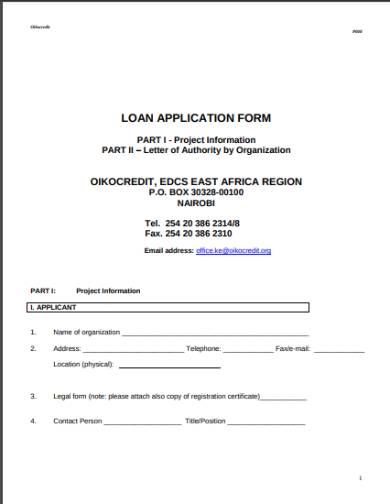

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free Printable Loan Agreement Form Form Generic

Net Debt Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Secured Loan Vs Unsecured Loan Top 5 Differences To Learn

9 Interesting God Of High School Facts Qta

18 Borrowing Capacity Halinalleyton

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

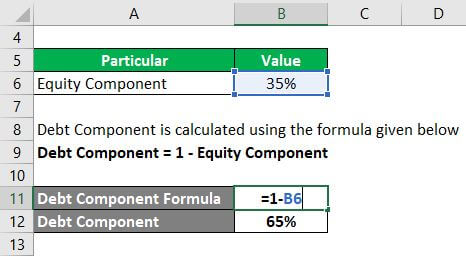

Capital Structure Complete Guide On Capital Structure With Examples

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Capital Structure Complete Guide On Capital Structure With Examples

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Net Debt Formula Calculator With Excel Template